July - August 2018

56

Disponible en línea en español.

Your Insurance

with

Cathy Karas

Cathy J. Karas, Certified Insurance Counselor, President, Karas

Insurance Agencies Inc, 321 So. Riverside Ave.,

Croton-on-Hudson, NY 10520

INSURING YOUR

FULL TIME OR

“ON THE SIDE”

COMMERCIAL

BUSINESS,

MARINE OR

OTHERWISE

I

t is common that some people decide to either make some extra money

on the side, while still employed to supplement their income, or take up some

part time work while retired. What is your exposure to a possible law suit by

doing this and assuming this risk of something going wrong in the process with

the work you are performing? What could possibly happen, you might think,

for this minimal exposure since either you are performing your “work” only a

few times a week and maybe for friends, family or referrals? First let’s see

if what you are doing is considered a “commercial” exposure. Anytime there

is an exchange of money or services! So the fact you accept cash only and

there is no “paper trail” with a check or credit card receipt does not let you off

the hook. Neither does an exchange of services, like bartering, as this can

also be considered a form of payment. First, a description of what a “full-time”

commercial marine type business might need as an example. Then some

scenarios of some home based, part time businesses that may operate out

of a home.

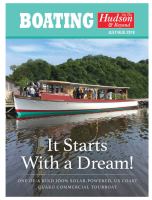

Some examples of types of businesses that require specialty marine

insurance include boat dealers, marinas, boat clubs, cruise or in water

transportation of any type, fishing charters , boat rentals, and marine repairers

and surveyors. Examples of policies they may need can include:

General liability insurance - bodily injury and/or property damage they may

cause through their “negligence”. Marina operator’s legal liability is another

coverage which includes coverage for the boats themselves while being

worked on or in their care, custody or control. All of the above businesses

need this type of insurance. If alcohol is served, liquor liability insurance as

a separate policy can be included if not an automatic coverage in the general

liability form or an endorsement that could be purchased as an add on to an

existing policy.

Boat insurance- if this is a cruise, water taxi, fishing charter, etc.. they also

may need a separate general liability insurance policy for the dockage hazard

of injury to passengers boarding or deboarding on land. Like your personal

boat policy, a commercial boat policy can provide insurance for hull, machinery

and equipment and bodily injury/property damage caused to others, as well as

injuries to passengers. If the boat is not relatively new, a survey will probably

required and all operators may need a full captain’s license.

Workers compensation - anyone paid to perform services under someone’s

business needs to be covered by a policy. Payment to the employee in cash

does not mean you don’t need this. This coverage pays the medical cost for the

injury plus a portion of the salary the injured employee is unable to collect due

to his inability to work. New York State also requires disability insurance for an

employee, which pays also pays a portion of salary for lost time from work due

to a nonwork related injury.

Vehicles and equipment - cars, trucks, trailers, cranes, barges, etc. all need

liability insurance even if not for road use, and can usually be insured for theft

and/or other physical damage.

So these are some of the types of policies a commercial business might have

to fully insure themselves, as a corporation, LLC or an individual. But what

about your own “on the side” business. Maybe you do shrink wrapping, boat

cleaning, transport services or take people out fishing. You may think that

because this is a small business on the side you can operate without insurance.

This is a dangerous situation as all of your personal assets are at risk in the

event of a loss resulting in a law suit. Particularly if you have not formed a

corporation or LLC for this entity, a judgment against you can mean future

earnings are garnished and/or liens against your home and any other assets

if you do not have insurance. For these marine exposures, yes you can buy

policies to cover your smaller exposure, with a lower cost than a full-time

commercial operation. Rates are often dependent on the gross annual sales

or payroll, so your cost for insurance would certainly be less than for a larger

business with employees.

For some other non-marine types of home based businesses, insurance

can be inexpensive, but this depends on what type of “business” you have.

One company we use for this type of exposure is RLI, who has a special in

home business policy. Some of the classes they can write are crafts, home

sewn items, perfumes, baking or food related items you prepare in your home,

knife sharpening, and offices. You may sell these items out of your home or

at flea or farmer’s markets and street fairs. The policy can include product

liability, and bodily injury/property damage insurance at the actual location of

the “event” you may be setting up a table to sell at. Often the venue you are

selling at requires insurance, and these in home business policies can satisfy

that requirement. If you are watching children at your home, even if for a friend

and there is any exchange of money or services, this is considered a “business”