June 2018

57

boatingonthehudson.com

lender wants to be sure their interest is protected, or a marina or boat club may

require you have liability insurance in the event you cause property damage

or bodily injury through your “negligence”. So, as you can imagine, there are

many boats and PWCs out there with no insurance if there is no loan and

not stored at a marina or club, as then insurance is voluntary. What is your

exposure as an owner if you do not have insurance? You may operate your

boat in a way that causes damage to another boat or dock or cause injury to

a passenger on your boat, another boat, someone in the water or on the dock

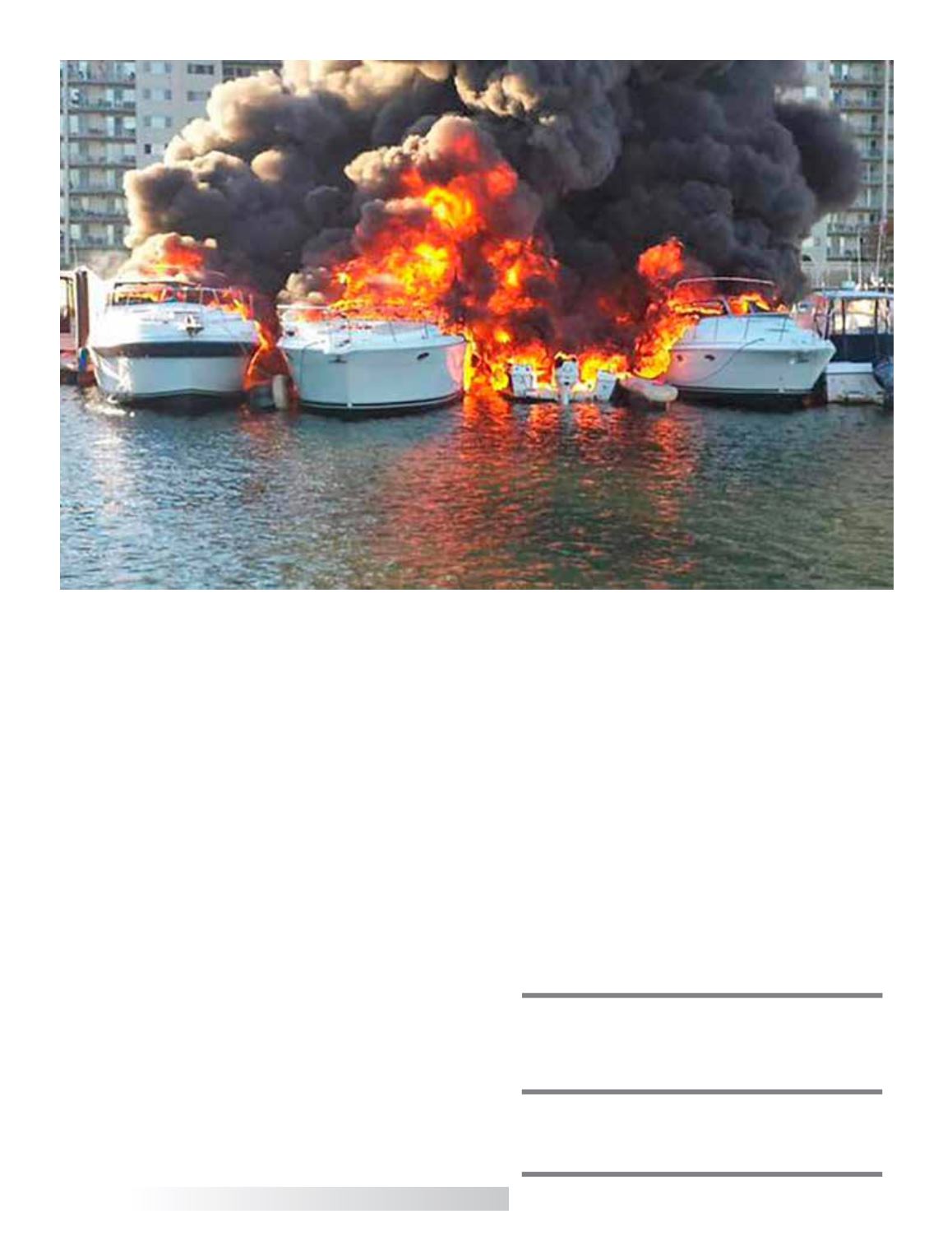

or shore. An electrical malfunction on your boat could set off a chain reaction

causing many boats to burn. A waterskiier could be struck or a passenger on

your own boat could lose their balance and fall into the water, hitting their head

causing severe injury. The list goes on of the potential catastrophic incidents

that could result in a law suit. A watercraft policy can provide coverage and

legal defense costs for you to protect you and your assets. Think about the

total of your assets, which may include a home, car(s), boat(s), investments

and even a future salary that could be garnished.

What can you do about protecting yourself with insurance from the uninsured

or underinsured boater? Most watercraft policies that you can buy for your

own boat or PWC have a coverage called under or insured boater liability. You

can usually purchase a limit equal to the liability limit you have selected for

your own boat, which can either be called bodily injury liability or protection

and indemnity insurance. I have not seen any New York insurance contract

that provides property damage coverage, that would pay for damage to your

own boat by underinsured or uninsured liability, only for bodily injury to you

or your passengers. I would think it a good idea not only to buy the highest

limit of bodily injury coverage not only for yourself, but also for the uninsured

and under insured boaters to protect you from these hazardous boat and PWC

operators. You may not think the cost of medical attention is not a concern

since you have your own medical insurance, but it is very possible at some

time you may have a passenger on your boat with no medical insurance where

this coverage would provide insurance coverage for medical costs if the other

negligent operator was found to be at fault and with no insurance or a low limit

that was insufficient to pay for the passengers injuries. This is a coverage you

can buy to provide insurance for injuries to yourself and your passengers and

not rely on another boater’s policy to respond, who caused the loss, where

there might not even be a policy.

The presence of Coast Guard and Police Boats seems to be more prevalent

since 9/11, so be aware of your speed with regards to distance to shoreline, that

you have the boater’s safety course card with you if by age you are required

to have taken it as I have outlined above. Be aware that a ticket or fine can

appear on your New York driver’s license and then affect your car insurance

premium with a surcharge, if you receive a moving violation, such as speeding.

Start the season safely making sure you have the proper education

requirements fulfilled, an insurance policy with adequate limits of coverage and

knowledge of the speed limits and rules of safe operation!

Cathy J Karas, President, Karas Insurance Agencies Inc, 321 South

Riverside Ave, Croton-on-Hudson, NY 10520. I can be reached by phone

(914-271-5188) or email

(cathykaras@karasinsurance.com) for any

questions or personal or commercial insurance quotes.

Disclaimer: This article is for informational purposes only. Contact the NY

State web site parks.ny.gov for the Boater’s Guide rules or your insurance

agent or company for information on your own policy.

photo

: www.mby.com